Understanding WACC: What It Costs Companies to Get Money

Have you ever wondered how companies pay for new projects or growth?

Just like you might need to borrow money for a car or use your savings, businesses need money too.

The cost of this money is called the Weighted Average Cost of Capital, or WACC for short.

What is WACC?

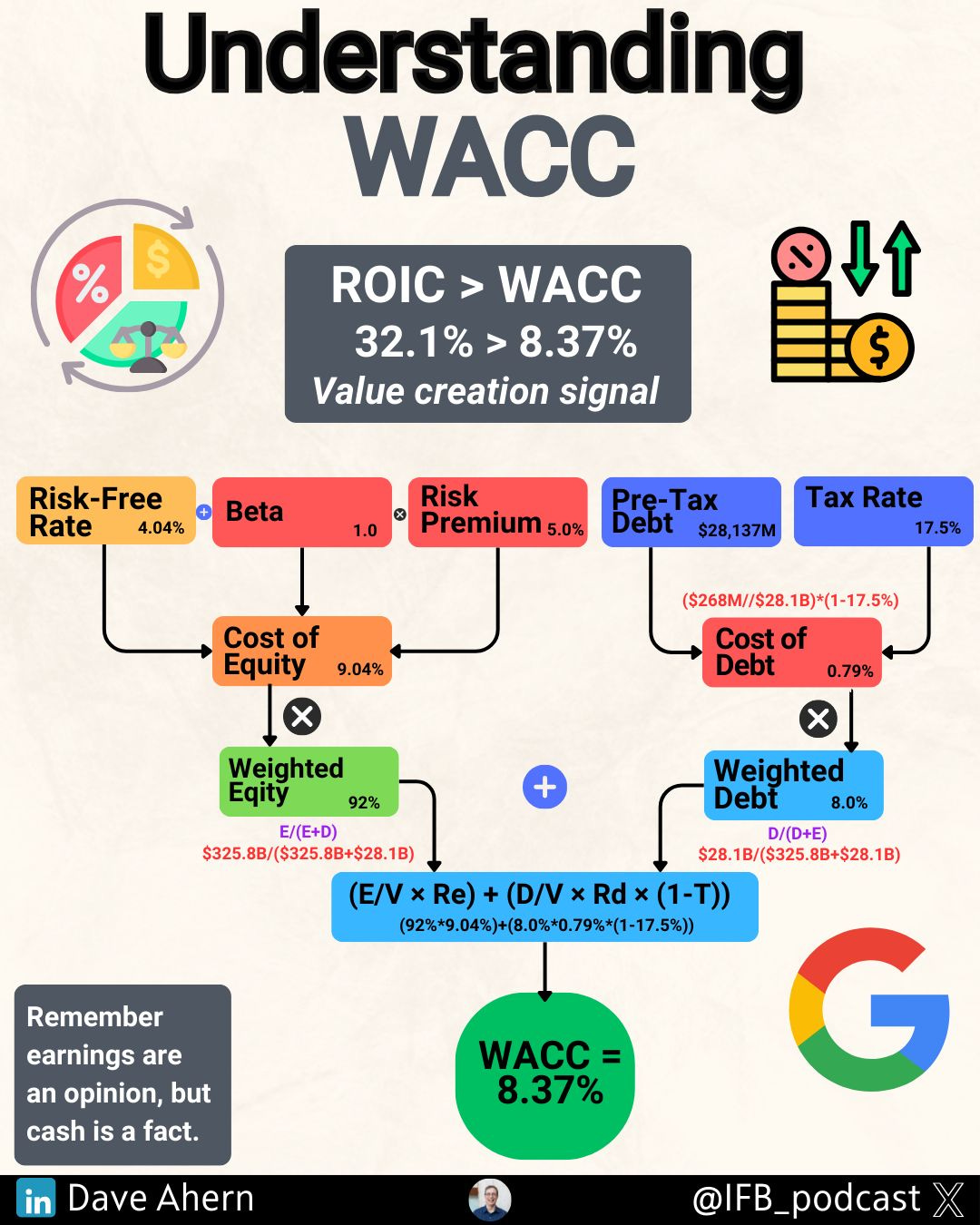

WACC is the average rate a company pays to get money from different sources. Think of it as the minimum return a business needs to make on its investments to keep investors happy.

The WACC Formula

The formula looks complicated but it's actually pretty simple:

WACC = (E/V × Cost of Equity) + (D/V × Cost of Debt × (1-Tax Rate))

Let's break this down:

• E = how much money comes from shareholders

• D = how much money comes from loans or bonds

• V = total money (E + D)

• Cost of Equity = what shareholders expect to earn

• Cost of Debt = interest rate on loans

• Tax Rate = company's tax percentage

Important Inputs

The most important parts of WACC are:

1. The mix of debt and equity (how the company gets its money)

2. Interest rates on loans

3. What return shareholders expect

4. Tax rates (since interest payments reduce taxes)

Why WACC Matters for Investors

Understanding WACC helps you in several ways:

• It shows if a company is making smart decisions about how to fund itself

• Lower WACC means a company can make more projects profitable

• It helps you compare different companies' financial health

• It signals how risky a business might be (higher WACC usually means higher risk)

When a company's returns are higher than its WACC, it's creating real value.

That's why smart investors pay attention to this number - it tells you if a company is truly making money after covering all its costs of getting capital.

Beta is not a fundamental intrinsic metric.

It is price volatility dependent.

And thus, WACC is price dependent and speculative.

Using Beta-dependent WACC as discount rate to derive DCF is dependent to the stock price fluctuation.