Explaining the Differences Between Free Cash Flow and Earnings

When you start exploring investments, you often hear about free cash flow and earnings. Both are important, but they mean different things. This guide will explain what they are, how they differ, and why that matters to you as an investor.

What Is Free Cash Flow (FCF)?

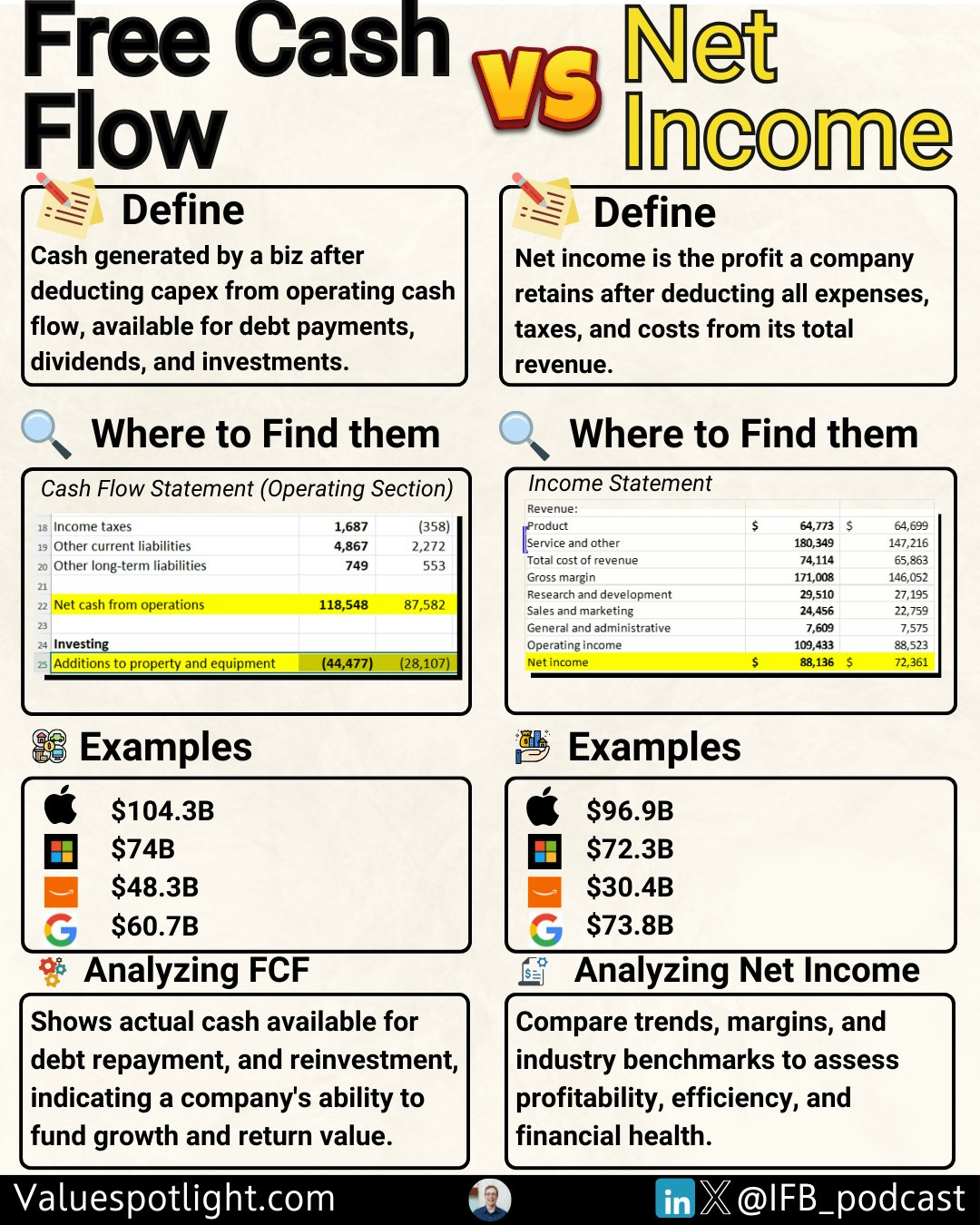

Free cash flow is the cash a company has left after paying its operating costs and buying or repairing equipment, buildings, or other long-term assets. In simple terms, it is the money a company can freely use for paying dividends, reducing debt, or investing in growth.

The formula for free cash flow is:

FCF = Operating Cash Flow − Capital Expenditures (CapEx)

Imagine earning money and then paying your bills and rent for the month. Whatever is left over is like your free cash flow. This leftover cash can give you a better sense of how strong your finances are.

What Are Earnings?

Earnings, also known as net income or profit, represent the money a company makes after it subtracts all its costs. These costs include operating expenses, taxes, and non-cash items like depreciation. Earnings are reported on the income statement and show how profitable the company is over a certain period.

Think of earnings as your paycheck. It shows how much you made after all your expenses are taken out. However, like a paycheck, earnings include items that do not involve cash, such as the gradual loss in value of equipment.

Key Differences Between FCF and Earnings

Understanding the differences between free cash flow and earnings can help you see the whole picture of a company’s finances.

Cash Flow vs. Accounting Profit

Earnings are based on accounting rules. They include expenses that do not use cash, such as depreciation. This means you might see a company with high earnings even if it has little cash in the bank.

Free cash flow, on the other hand, shows actual cash. It tells you how much money is available right now for paying bills, dividends, or reinvesting back into the company.

Impact of Investments

Earnings do not deduct the cash spent on new equipment or facilities right away. Instead, these costs are spread out over time. Free cash flow subtracts this cost immediately, giving you a clear view of cash remaining after all costs.

Ease of Manipulation

Different accounting practices can sometimes change earnings. Free cash flow is based on cash numbers, making it harder to change with just an accounting trick.

Why It’s Important to Understand the Difference

For investors, understanding the distinction between free cash flow and earnings is particularly beneficial. Here’s why:

Real Cash vs. Paper Profit: Earnings can show profit even if the company does not have much cash. Free cash flow shows how much cash is available.

Dividend Safety: Dividends come from real cash. A company with strong free cash flow is more likely to sustain or increase dividend payments.

Healthy Operations: If earnings look good but free cash flow is low or negative, there might be problems like heavy spending on equipment or poor working capital management.

Accurate Value: Relying on both helps you avoid companies that look profitable on paper but struggle with cash issues.

How to Analyze FCF and Earnings

Here are some practical tips:

Look at Trends Over Time

Watch how both earnings and free cash flow change over several periods. Steady or growing free cash flow can be a sign of a strong company. If earnings are up but free cash flow is falling, you might want to dig deeper.

Compare Within Industries

Different industries have different needs. Capital-heavy businesses, such as manufacturing, often have lower free cash flow due to their high equipment expenditures. Compare companies in the same industry to get a better picture.

Check Dividend Policies

When a company pays dividends, it should have enough free cash flow to do so. Compare the amount of free cash flow to the dividend payouts to see if they are sustainable.

Use Them Together

Use earnings to get an idea of profit and free cash flow to understand cash strength. Together, they provide a fuller picture of a company’s overall health.

A Simple Analogy

Imagine you run a small winery.

Earnings are essentially your monthly profit after deducting all expenses, including rent and grape costs, even if some costs are not yet paid in cash.

Free Cash Flow is the money you have in your cash register after paying for daily expenses and buying new fermentors or barrels.

This analogy shows that while profit numbers are important, the cash available is what helps you keep the winery running day to day.

Final Thoughts

Free cash flow and earnings each tell a different part of a company’s story. Earnings show profit on paper, while free cash flow tells you the real cash available for growth, dividends, or debt reduction. By looking at both, you can make smarter investment decisions and avoid surprises. Always remember that a complete picture comes from understanding both the profits and the cash.